by Wang Kai

TIANJIN, Jun 26 (China Economic Net) – Amid financial sector uncertainty, non-US dollar currencies from the RMB to the Euro are representing a growing share of sovereign reserves and being used increasingly in trade invoicing.

At the World Economic Forum being held in Tianjin this week, economists highlighted that dollar's dominance—long buttressed by US institutional strength, market depth, and global trust—is under pressure from both inside and outside the US, slowly chipping away at the greenback's monopoly.

A game of trust

Over the past five months, the shift away from the dollar has become increasingly evident. The U.S. Dollar Index has plunged roughly 9.4% so far this year—its steepest first-half decline since 1986. In a landmark signal, data released in February by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) revealed that the dollar's share in global payments fell below 50% for the first time on record.

Economists say this isn't merely a short-term fluctuation, but a reflection of deeper global recalibrations.

Diana Choyleva, Chief Economist at British think tank Enodo Economics, attributes this trend not only to immediate market jitters but also to a deeper transformation in how the world conducts business.

"There's a structural transformation underway in how the world conducts cross-border transactions," said Diana Choyleva, Chief Economist at British think tank Enodo Economics. "One of the key reasons for holding the U.S. dollar has been its role as a transaction medium. But dollar-based payments remain slow, costly, and opaque—often requiring several days and multiple intermediaries."

Choyleva pointed to emerging technologies such as blockchain-based stablecoins and central bank digital currencies (CBDCs), which promise faster and more efficient global settlements. These innovations, she argues, could steadily erode demand for the dollar in global trade and reserves.

Jeffry Frieden, Professor of International and Public Affairs at Columbia University, sees the trend as part of a broader and potentially irreversible shift. "Much of what's happening is structural. If the contradictions in U.S. fiscal and monetary policy continue to deepen, global confidence will erode further," he warned. "In fact, the dollar's dominance could eventually become a liability for the U.S. itself."

Beyond technological lag, experts say the U.S. dollar is also losing its edge due to waning institutional credibility.

"This is not just about currency mechanics—it's about trust in American governance," said Choyleva. "Especially after the Trump years, confidence in U.S. institutional competence and exceptionalism has taken a serious hit."

Philippe Laurensy, CEO Asia Pacific at Euroclear Group, echoed the concern. "As uncertainty becomes the prevailing sentiment, this shift away from the dollar is no longer cyclical—it's fundamental," he said.

Frieden added, "We may still rely on the dollar for transactions, but its fading appeal as a reserve currency is clearly linked to growing doubts about U.S. policy coherence and reliability."

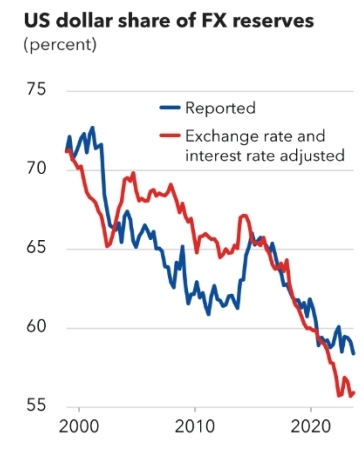

Reduced role of the US dollar over the last two decades. Source: IMF

What's the next safe haven?

While no single currency is poised to dethrone the dollar overnight, viable alternatives are gaining momentum.

China's Cross-Border Interbank Payment System (CIPS), along with a growing number of bilateral currency swap agreements, is allowing countries to bypass the dollar-dominated SWIFT network. These tools are seen not just as financial instruments, but as strategic alternatives in an evolving geopolitical landscape.

"The RMB could become the main alternative," Choyleva said, citing its rapid internationalization—particularly within the BRICS bloc and among major energy exporters like Russia and Gulf nations.

Eswar Prasad, former head of the IMF's China Division, pointed to a notable trend: "We're seeing more countries managing their currencies in reference to RMB. The willingness to peg or shadow the RMB is a clear signal of its rising status."

China's strategic use of RMB-denominated trade and investment agreements—combined with its central role in global supply chains—is reinforcing the renminbi's position. "This is not just an economic shift. It's geopolitical," said Frieden. "As China's economic network expands, using the yuan becomes a natural extension for its partners."

On the other hand, the Euro—once seen as the most viable contender to the dollar—is constrained by internal fragmentation and external vulnerability. "You can't be a safe haven if you're divided within and threatened from without," Frieden remarked, referencing the eurozone's fragility amid the Russia-Ukraine conflict.

He warned, "The very dominance that once empowered the US may soon begin to constrain it—unless it regains global confidence in both its policies and institutions."

(Editor: liaoyifan )