By Wu Siya

BEIJING, Jul 30 (China Economic Net) - On July 4, US President Donald Trump signed the highly controversial One Big Beautiful Bill Act, raising the US federal debt ceiling by $5 trillion to $41.1 trillion. The bill will increase the fiscal deficit by $3.4 trillion over the next 10 years and add $4.1 trillion to the US national debt.

It is quite clear that the bill's implementation marks another setback for Trump's campaign promises to cut fiscal spending. No one knows the exact time when the US debt crisis will break out, but the "last straw" that will break the camel's back is approaching.

Can the ceiling stop the massive expansion?

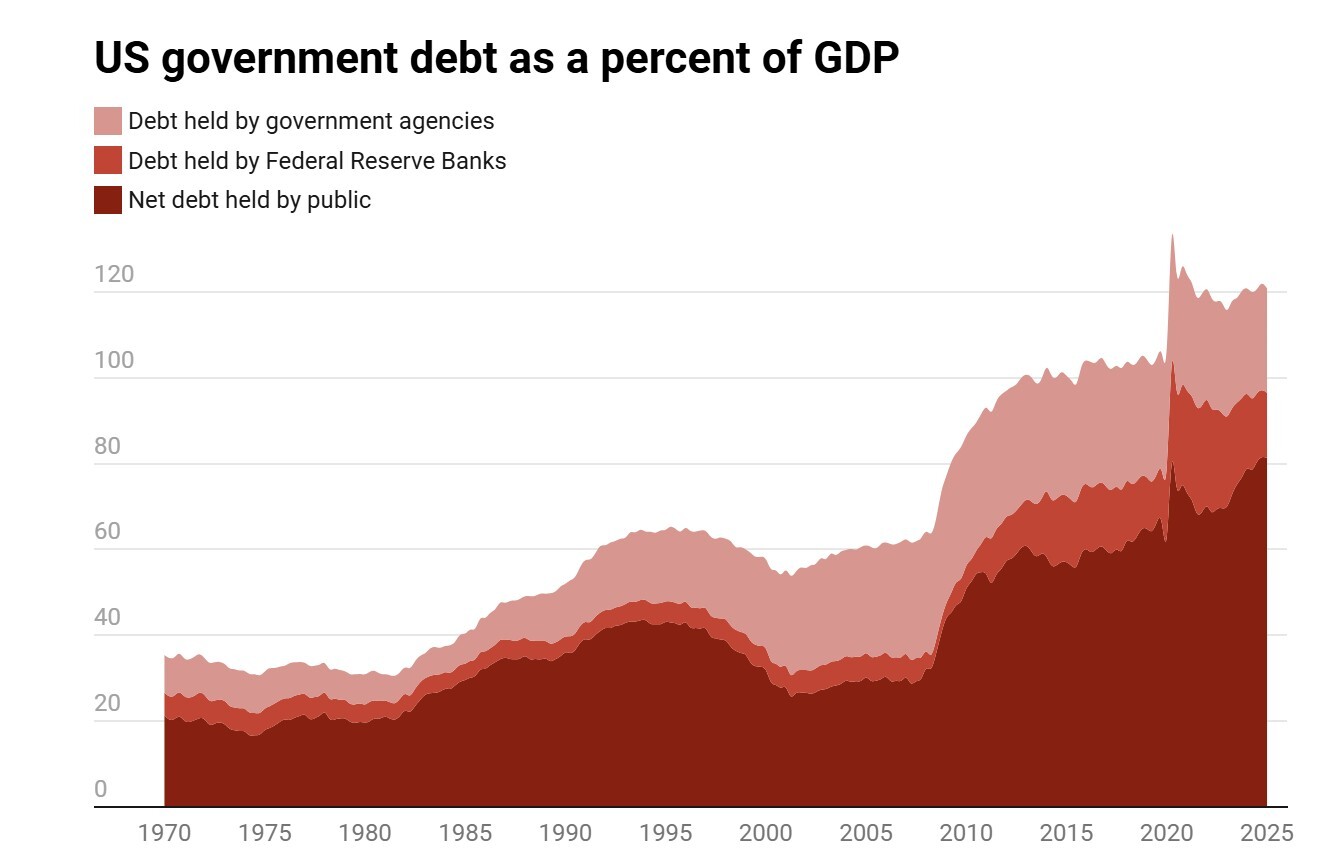

In 2019, the US national debt was approximately $23.2 trillion. By early 2025, it had reached its upper limit of $36.1 trillion, representing a debt increase of nearly $13 trillion over five years. By comparison, the absolute size of the US national debt has ranked first in the world for ten consecutive years, making it the primary driver of debt growth among developed countries.

US government debt as a percent of GDP [Photo/Federal Reserve Economic Data]

Frequent increases in the U.S. debt ceiling have failed to stem the rapid rise of the national debt. “The debt ceiling is essentially a political creation, part of the ‘power of the purse,’ with Congress using debt as a key tool to limit federal government spending,” Ma Wei, assistant researcher at the Institute of American Studies of the Chinese Academy of Social Sciences, told China Economic Net. “However, under the two-party system, this has gradually evolved into a political game between the Donkey and Elephant. Since 1939, the debt ceiling has been raised 108 times, an average of once every nine months. The size of the U.S. national debt has also soared from $40 billion to $36.1 trillion.”

“Repeated breaches of the debt ceiling severely impacted the stability of global financial markets,” Ma noted. The bipartisan standoff during the debt ceiling crisis of the summer of 2011 lasted until the final moment on August 2. A warning from then-U.S. Treasury Secretary Timothy Geithner stated that if the $14.29 trillion debt ceiling was not raised by August 2, the government would be forced to default on $62 billion in social security payments and be unable to pay interest on the Treasury bond, leading to a U.S. debt default.

A post-crisis analysis by the Bank for International Settlements showed that the crisis caused a 40% drop in global corporate bond issuance, as well as a 25% contraction in cross-border bank lending. Ironically, U.S. debt, the very trigger of the crisis, became a safe haven asset, with the 10-year Treasury yield plummeting from 2.96% to 2.03%. With Moody's downgrading the U.S. debt’s credit rating in May 2025, the United States simultaneously lost its top rating from all three major international rating agencies for the first time in its history.

The sustainability crisis of the US debt

“The interest burden highlights the sustainability crisis of the U.S. debt. In the foreseeable future, the U.S. government has neither the willingness nor the ability to repay the principal of this massive debt, and will instead continue to roll over existing debt by borrowing new money to repay old debt,” Yuan Zheng, the vice-president and secretary general of the Chinese Association for American Studies, introduced, “therefore, the key factor affecting the sustainability of US debt is the ability to pay interest.”

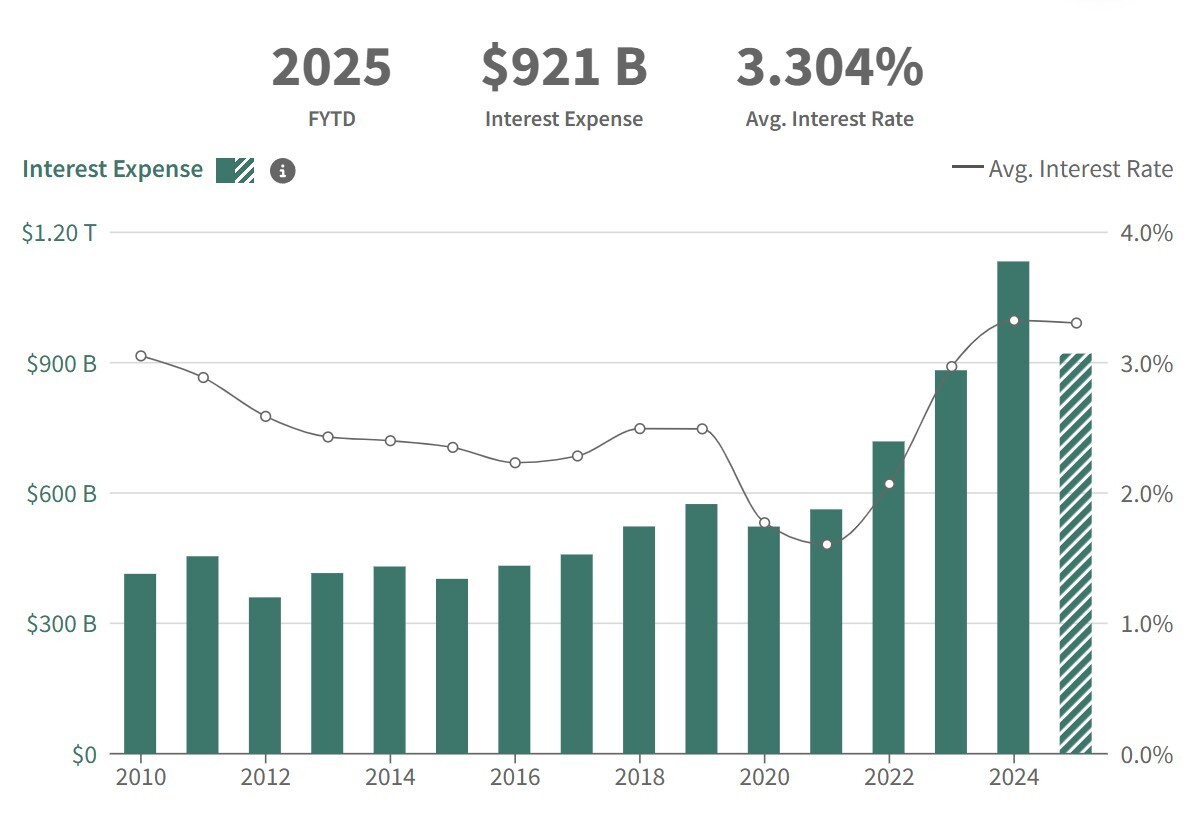

In fiscal year 2024, the U.S. debt interest payments surged 29% to $1.1 trillion, accounting for more than 13% of the federal government's total spending. Interest, deficits and debt have formed a spiraling trend. Looking at the ratio of net interest expenditure to GDP, the historical average level in the United States is 1.7%, but it has increased significantly in recent years, reaching a peak of 3.1% in fiscal 2024, while 2.5% is already the warning line for a serious excess of interest burden.

Yuan told the reporter that on the other hand, the growth of debt and interest alone does not necessarily lead to unsustainable debt; economic growth also needs to be considered. In theory, the "r-g" indicator-the difference between long-term interest rates (r) and GDP growth (g)-is the fundamental measure of debt sustainability.

For decades, the United States has long been in an environment where r < g, but this situation has begun to change in recent years. With declining inflation, nominal GDP growth in the United States has slowed from 10.9% in 2021 to 5.3% in 2024. Meanwhile, the era of low interest rates in the United States may be over. In March 2022, the Federal Reserve began a cycle of interest rate hikes, and US interest rates have continued to rise. Correspondingly, US debt interest rates have also been rising. By the end of 2024, the weighted average interest rate on outstanding US debt reached 3.3%, the highest level since the 2008 international financial crisis. Even though the Federal Reserve began a cycle of interest rate cuts in September 2024, the 10-year Treasury bond yield remained above 4%.

Interest Expense and Average Interest Rates on the National Debt FY 2010 - FYTD 2025 [Photo/US Treasury Securities data]

Many studies suggest that the US debt market will face high-interest rate pressure for an extended period. “As can be seen, the decline in nominal economic growth and the rise in interest rates have led to a continued increase in the "r-g" ratio, which will continue to threaten the sustainability of US Treasury bonds in the coming years,” added Ma.

The dollar’s arrogant hegemony is disappearing

The “arrogant hegemony” of the US dollar is the main factor supporting the substantial expansion of US debt without falling into crisis. According to data from the International Monetary Fund, in early 1970, the U.S. dollar accounted for only about 62% of global foreign exchange reserves. By 1977, it had reached 80%. Although it has declined since then, it still remains around 60%. Due to the large scale and good liquidity of the U.S. debt, it has become the most important asset in the foreign exchange reserves of various countries. This makes it the de facto anchor of global currency.

“When a large amount of funds flow into the U.S. debt market, it will cause U.S. debt prices to rise and yields to fall, which further strengthens the safe-haven status of U.S. debt.” According to Ma, although the 2008 international financial crisis originated in the United States, it led to a sharp increase in global demand for U.S. debt within a short period of time, even leading to a "dollar shortage." This anomaly exposed a deep-seated contradiction in the global financial system: even when U.S. debt faced a credit crisis, the market could not find safer alternatives. The stability and security of U.S. debt directly impacted the stability and confidence of global financial markets, demonstrating the primacy of American exceptionalism in global financial markets.

However, the triple kill of stocks, debts and currencies still highlights the dilemma of American exceptionalism. In April, under the influence of the reciprocal tariff policy, the United States experienced a rare phenomenon of stocks, debts and the US dollar index falling sharply at the same time, behind which was the accelerated outflow of international capital from the United States. The U.S. debt even had to repurchase a record $10 billion in Treasury bonds in June.

“From a medium- to long-term perspective, the declining global dominance of the US economy in recent years has fundamentally shaken the status of the US dollar and US debt. The US share of global GDP has fallen from 33% in 2000 to around 25% in recent years,” Yuan pointed out.

In July, the proportion of global central bank gold reserves exceeded 20%, reaching a new high since the collapse of the Bretton Woods system, which is actually a collective flight from the credit of the US dollar-in 2024, global central banks reduced their holdings of US bond by $1.2 trillion, a record high. Stephen Milan’s Mar-a-Lago agreement, which for the first time proposed exchanging US bond for “Century Bonds,” is tantamount to a disguised national default. Bridgewater Associates founder Ray Dalio’s prediction of a “breakdown occurs only about once in a lifetime” is coming true. The US dollar hegemony, established by the Bretton Woods system in 1944, has entered an irreversible decline.

(Editor: wangsu )