by Wu Siya

BEIJING, Sept 17 (China Economic Net)- On September 17, local time, the minutes of the Federal Open Market Committee (FOMC) monetary policy meeting of the Federal Reserve showed that the Fed decided to lower the target range of the federal funds rate by 25 basis points to between 4.00% and 4.25%, which is the first interest rate cut by the Fed since December 2024.

Although US inflation has risen and remained slightly elevated, job creation in recent months has fallen far short of expectations, prompting the Fed to finally cut interest rates. Notably, Stephen Milan, the newly appointed Fed Governor and current Chairman of the White House Council of Economic Advisers, was the sole dissenter, favoring a 50-basis point rate cut. Meanwhile, Fed policymakers’ forecasts suggest another 50 basis point cut in 2025, followed by 25 basis point cuts in 2026 and 2027.

Not a cure-all

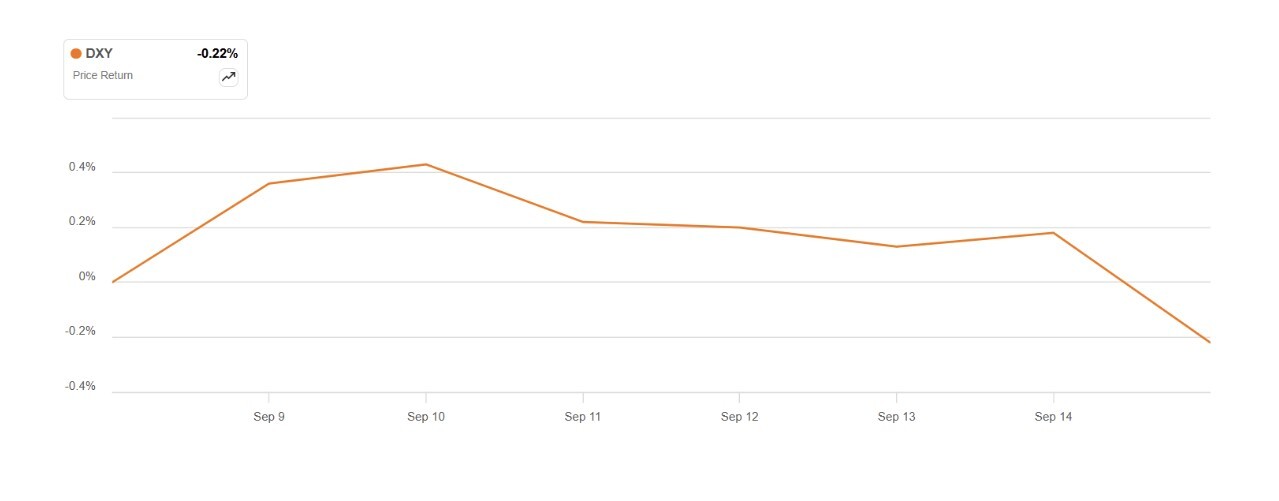

The U.S. Dollar Index (DXY), which measures the value of the dollar against a basket of six foreign currencies, declined 0.22% over the last week.

The U.S. Dollar Index (DXY)

And after the news of the interest rate cut was announced, the US dollar index fell below the low point in early July to 96.22, hitting a new low since February 2022.

Obviously, the US dollar came under pressure after the Federal Reserve finally announced a rate cut, which “will further reduce the relative returns of US dollar assets, thereby pushing down the US dollar index as the market prices in interest rate cuts and risk appetite recovers,” Ma Wei, assistant researcher at the Institute of American Studies of the Chinese Academy of Social Sciences, told China Economic Net.

By now, most foreign exchange market participants believe that the dollar's decline is difficult to reverse in the short term. They current concerns about the dollar include the dual pressures of the fiscal and trade deficits, the possibility that a weak job market may prompt more aggressive interest rate cuts, and global fund managers re-examining their foreign exchange hedging strategies to reduce their dollar exposure.

Not only that, the weak US employment data in the past few weeks has provided room for the Federal Reserve to cut interest rates more significantly, which will weaken the dollar’s interest rate advantage.

Multiple true cause

On September 14, local time, the US government filed a request with the US Court of Appeals to allow it to fire Fed Governor Lisa Cook, thereby preventing Cook from participating in interest rate meetings.

“Trump’s historic use of presidential power to fire a Fed governor has sparked global concerns about the Fed’s independence. However, the extent of the subsequent tensions will depend on whether the new nominees remain fully committed to the president’s orders or maintain relatively neutrality,” Ma pointed out.

At a press conference after the Fed announced the rate cut, topics such as whether the Federal Reserve is facing political pressure have been mentioned many time. But Jerome Powell avoided commenting on whether the Trump administration's mortgage fraud case against Lisa Cook undermined the Fed’s independence. “I see it as a court case that it would be inappropriate for me to comment on,” he said.

However, in any case, increasing government intervention will lead to greater challenges to the Fed’s independence, making its decision-making more susceptible to political factors as well as weakening its efforts to curb inflation. Erosion of the Fed’s independence will also undermine the credibility of the US dollar and its status as a global reserve currency.

Furthermore, global markets generally believe that the negative factors that dragged down the US dollar in the first half of this year persist. Paresh Upadhyaya, Director of Fixed Income and Currency Strategy at Amundi, stated, “The market is beginning to assess the extent of US economic weakness-for example, how much weaker will the labor market be going forward, and what this means for the Fed’s monetary policy.” Upadhyaya has been bearish on the US dollar since the beginning of the year and has continued to increase his short dollar position. “There’s no reason to change strategy at this point.”

If the Fed cuts interest rates further, it will naturally increase foreign investors’ willingness to hedge against dollar assets.

From a top-down perspective, the America First agenda and plans to revitalize U.S. manufacturing run counter to a strong dollar strategy. Will the White House acquiesce to a devaluation of the dollar?

And Thanos Bardas, managing director and co-head of global investment-grade fixed income at Neuberger Berman, expects the dollar index to hover between 95 and 100 in the short term.

“Trump’s attitude has always been self-contradictory. He wants the dollar to depreciate to promote exports and the reshoring of manufacturing, but he also hopes to maintain monetary hegemony through a strong dollar,” Ma told. “However, without a fundamental change in the US industrial structure and division of labor, no amount of dollar devaluation will achieve the goal of reshoring manufacturing.”

“Undoubtedly, in the short term, the downward pressure on the US dollar has increased significantly. The long-term trend requires a comprehensive observation of changes in US economic growth. If the US economy could maintain a certain growth rate, the downward trend of the US dollar index is expected to ease. Otherwise, it will ‘plunge,’” Ma emphasized to CEN, adding that against the backdrop of the dollar’s damaged credit and rising uncertainty in U.S. foreign policy, some countries may accelerate the process of de-dollarization by promoting local currency settlement and diversification of foreign exchange reserves, further weakening the dollar’s dominant position in global capital flows.

(Editor: wangsu )