By Wu Siya

BEIJING, Nov. 28 (China Economic Net) - The latest monthly report from the U.S. Treasury Department shows that, despite the government shutdown throughout October, record-breaking tariff revenue significantly boosted government income.

However, spending still exceeded revenue, resulting in the largest October deficit in history for the federal government in the first month of the new fiscal year, which means Uncle Sam has just experienced the worst start to a fiscal year.

Tariffs Skyrocketing

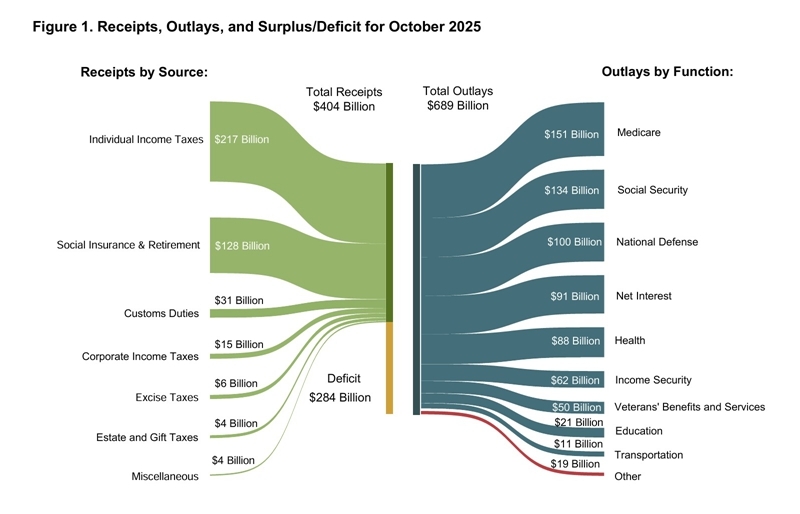

Data shows that in October, US tariff revenue surged to $31 billion, a year-on-year increase of 330%, driving total revenue for the month to $404 billion, setting a new historical record for October. The surge in tariffs is related to the US's previous tariff increase policies, and particularly in the context of trade tensions, the tariffs paid by importing companies have risen significantly.

Monthly Treasury Statement for Oct 2025 [Photo/ Department of the Treasury]

It's no wonder that President Trump recently announced on social media that he would distribute a “bonus of at least $2,000 per person” to all Americans except "high-income earners," adding, "This money will come from tariff revenue!"

“People that are against Tariffs are FOOLS! We are now the Richest, Most Respected Country in the World, With Almost No Inflation, and A Record Stock Market Price. 401k’s are Highest EVER,” the president wrote.

Sounds very tempting, doesn't it?

Cannot make ends meet

Nevertheless, government spending still far exceeded revenue. Due to the government shutdown throughout the month, some federal employee salaries and other related projects were delayed until the end of the year, resulting in a slight decrease in October spending, but the overall figure still reached $689 billion. Treasury officials stated that the impact of the shutdown on spending was less than 5%.

Ultimately, the U.S. Treasury Department announced a net deficit of $284 billion for October, setting a record for the largest October deficit in history.

On the other hand, it's worth considering that the situation is slightly less severe after adjustments. Because November 1st fell on a Saturday, several government payments that were originally due in November were disbursed in October. Excluding this timing factor, the adjusted deficit for October was approximately $180 billion, a 29% decrease compared to October 2024.

Historically, the U.S. Treasury Department has never recorded a surplus in October since fiscal year 1955, with this year was no exception. Even with tariffs reaching record highs, it failed to break the 70-year pattern of an "October deficit."

The IMF stated last month that current US tariff measures are unlikely to substantially reduce debt and urged the US government to take further steps to address the persistently high deficit. The IMF predicts that the US will remain the country with the largest deficit among the world's wealthiest economies, and its World Economic Outlook report, released in mid-October, predicts that although tariff revenue is expected to contribute approximately 0.7% of GDP, the US general government fiscal balance as a percentage of GDP will worsen by 0.5 percentage points in 2026 due to stimulative policies such as the "One Big Beautiful Bill." Under current fiscal policies, US public debt is projected to rise from 122% of GDP in 2024 to 143% in 2030, 15 percentage points higher than the April forecast.

The situation is far less optimistic than President Trump claims. Several U.S. states filed a joint lawsuit on November 25, demanding that the Trump administration restore more than $3 billion in aid funds that were originally intended to provide permanent housing and other services for the homeless. Lawsuits filed by various states indicate that these changes could result in more than 170,000 people losing their homes.

Butterfly effect

Global investors are closely monitoring US deficit trends, as an unsustainable increase in federal debt levels would force the government to implement stricter fiscal austerity measures.

At the same time, rising debt levels also increase interest payments, creating a vicious cycle. US government interest payments reached $104 billion in October, the highest level ever for that month, primarily due to rising debt interest costs. Over the past 12 months, interest payments have totaled $1.24 trillion, equivalent to 24 cents of every dollar collected in taxes being used to pay interest on debt, highlighting the heavy debt burden.

And by 2025, the US federal debt is projected to exceed $36 trillion, with annual interest payments approaching $900 billion-exceeding the combined total of all non-defense spending on social programs such as education, housing, and transportation. Every dollar spent on interest payments means one less dollar available for childcare or community healthcare.

“Tariffs could increase import costs, suppress corporate profits, and subsequently reduce corporate income tax revenue,” Ma Wei, assistant researcher at the Institute of American Studies of the Chinese Academy of Social Sciences, told China Economic Net.

“Clearly, enterprises will pass on these costs in two ways: by raising the prices of finished goods, meaning consumers will bear higher prices; and by lowering workers' real wages. In 2025, real wages in the US manufacturing sector have already decreased by 2.3% due to inflation and corporate cost pressures, meaning workers are indirectly bearing a portion of the companies' tax burden. 'Corporate tax cut, public pays the bill' model is completely unsustainable,” Ma pointed out.

On the whole, the ever-increasing debt interest payments and irreversible growth in mandatory spending are like a "ticking time bomb." As time goes on, the market will pay increasing attention to the issue of fiscal sustainability in the United States.

(Editor: fubo )